Bonds and ratings

Our bonds1

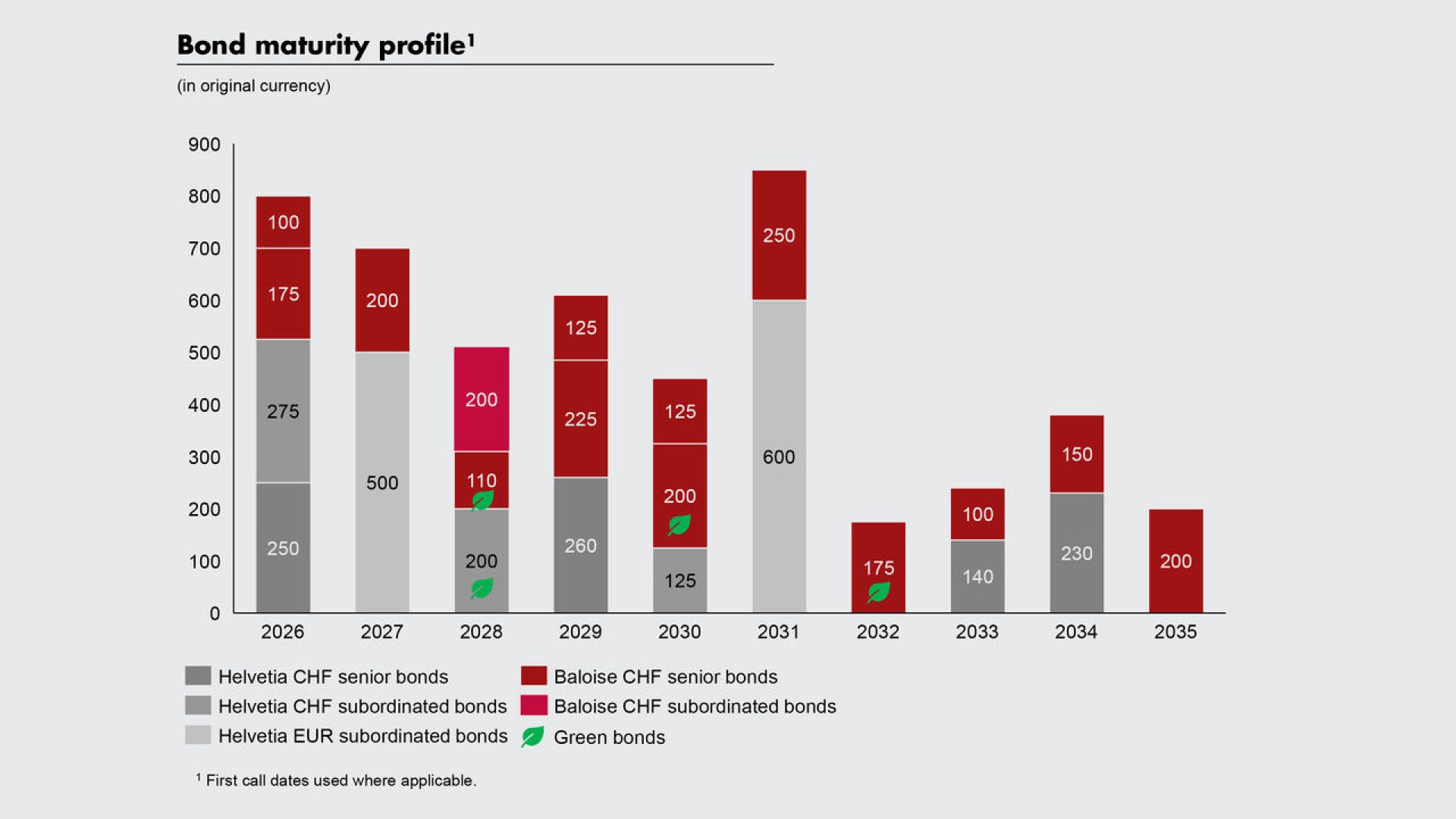

| Type/issuer | Term sheet & prospectus | Nominal volume | Coupon p.a. | Year of issuance | Maturity | ISIN |

|---|---|---|---|---|---|---|

| Subordinated bond / Baloise Life Ltd | Prospectus | CHF 200 million | 2.20% until 2028, then variable | 2017 | 19.06.20482 | CH0379611004 |

| Subordinated bond /Helvetia Schweizerische Versicherungsgesellschaft AG | Term sheet Prospectus |

EUR 500 million | 3.375% until 2027, then variable | 2017 | 29.09.20473 |

XS1587893451 |

| Senior bond/ Baloise Holding AG | Prospectus | CHF 100 million | 0.00% | 2019 | 25.09.2026 | CH0496692978 |

| Senior bond / Baloise Holding AG | Prospectus | CHF 125 million | 0.00% | 2019 | 25.09.2029 | CH0496692986 |

| Senior bond / Baloise Holding AG | Prospectus | CHF 175 million | 0.25% | 2020 | 16.12.2026 | CH0553331817 |

| Senior bond / Baloise Holding AG | Prospectus | CHF 125 million | 0.50% | 2020 | 16.12.2030 | CH0553331825 |

| Subordinated bond / Helvetia Schweizerische Versicherungsgesellschaft AG |

Term sheet Prospectus |

CHF 275 million | 1.50% until 2026, then variable | 2020 | undated4 | CH0521617305 |

| Subordinated bond / Helvetia Schweizerische Versicherungsgesellschaft AG | Term sheet Prospectus |

CHF 125 million | 1.45% until 2030, then variable | 2020 | 12.08.20405 | CH0521617313 |

| Subordinated bond / Helvetia Europe S.A. | Term sheet Prospectus Annual Report Helvetia Europe |

EUR 600 million | 2.75% until 2031, then variable | 2020 | 30.09.20416 | XS2197076651 |

| Green subordinated bond / Helvetia Schweizerische Versicherungsgesellschaft AG | Term sheet Prospectus |

CHF 200 million | 1.75% until 2028, then variable | 2020 | undated7 | CH0579132959 |

| Senior bond / Baloise Holding AG | Prospectus | CHF 250 million | 0.15% | 2021 | 17.02.2031 | CH0593641068 |

| Green senior bond / Baloise Holding AG | Prospectus | CHF 200 million | 0.125% | 2021 | 27.06.2030 | CH1130818839 |

| Senior bond/ Baloise Holding AG | Prospectus | CHF 200 million | 0.30% | 2022 | 16.02.2027 | CH1148728210 |

| Green senior bond / Baloise Holding AG | Prospectus | CHF 110 million | 1.90% | 2022 | 19.07.2028 | CH1199322350 |

| Senior bond / Baloise Holding AG | Prospectus | CHF 225 million | 2.20% | 2022 | 30.05.2029 | CH1206367661 |

| Senior bond / Helvetia Schweizerische Versicherungsgesellschaft AG | Term sheet Prospectus |

CHF 250 million | 1.45% | 2022 | 25.06.2026 | CH1194000324 |

| Senior bond / Helvetia Schweizerische Versicherungsgesellschaft AG | Term sheet Prospectus |

CHF 150 million | 1.95% | 2022 | 25.06.2029 | CH1194000332 |

| Green senior bond / Baloise Holding AG | Prospectus | CHF 175 million | 2.20% | 2023 | 30.01.2032 | CH1232107180 |

| Senior bond / Baloise Holding AG | Prospectus | CHF 100 million | 2.35% | 2023 | 02.05.2033 | CH1256367199 |

| Senior bond/ Baloise Holding AG | Prospectus | CHF 150 million | 1.75% | 2024 | 07.06.2034 | CH1348614145 |

| Senior bond/ Helvetia Schweizerische Versicherungsgesellschaft AG | Term sheet Prospectus |

CHF 230 million | 1.95% | 2024 | 26.06.2034 | CH1353257863 |

| Senior bond / Helvetia Schweizerische Versicherungsgesellschaft AG | Term sheet Prospectus |

CHF 110 million | 0.80% | 2025 | 31.01.2029 | CH1400064494 |

| Senior bond/ Baloise Holding AG | Prospectus | CHF 200 million | 1.315% | 2025 | 16.07.2035 | CH1454185880 |

| Senior bond / Helvetia Schweizerische Versicherungsgesellschaft AG | Term sheet Prospectus |

CHF 140 million | 1.10% | 2025 | 31.01.2033 | CH14000640 |

| Helvetia Green Bond Report 2023 | EN | ||

| Helvetia Green Bond Report 2023 – Review von Sustainalytics | EN | ||

| Helvetia Green Bond Framework | EN | ||

| Helvetia Green Bond Frameword Second Party Opinion | EN | ||

| Baloise Green Bond Report 2025 | EN | ||

| Baloise Green Bond Report 2025 – Review von Sustainalytics | EN | ||

| Baloise Green Bond Framework | EN | ||

| Baloise Green Bond Framework Second Party Opinion | EN | ||

| Helvetia Green Bond Report 2023 | ||

| EN | ||

| Helvetia Green Bond Report 2023 – Review von Sustainalytics | ||

| EN | ||

| Helvetia Green Bond Framework | ||

| EN | ||

| Helvetia Green Bond Frameword Second Party Opinion | ||

| EN | ||

| Baloise Green Bond Report 2025 | ||

| EN | ||

| Baloise Green Bond Report 2025 – Review von Sustainalytics | ||

| EN | ||

| Baloise Green Bond Framework | ||

| EN | ||

| Baloise Green Bond Framework Second Party Opinion | ||

| EN | ||

Our Ratings

Helvetia Baloise’s ratings are a reflection of its excellent capitalisation. You can find Helvetia Baloise’s credit and financial strength ratings here.

| The rating of Helvetia is essentially based on the two subsidiaries, namely Helvetia Schweizerische Versicherungsgesellschaft AG and Helvetia Schweizerische Lebensversicherungsgesellschaft AG. Standard & Poor’s Global Ratings also assigned its “A+” rating to Helvetia Assurances S.A. with a stable outlook. | |

| Helvetia Schweizerische Versicherungsgesellschaft AG | 'A+' / stable |

| Helvetia Schweizerische Lebensversicherungsgesellschaft AG | 'A+' / stable |

| Helvetia Assurances S.A.* | 'A+' / stable |

| Helvetia Global Solutions Ltd. |

'A' / stable |

| Baloise Versicherung AG (Schweiz) | 'A+' / stable |

| Baloise Belgium N.V. (Belgien) | 'A+' / stable |

| Baloise Sachversicherung AG Deutschland | 'A+' / stable |

| The rating of Helvetia is essentially based on the two subsidiaries, namely Helvetia Schweizerische Versicherungsgesellschaft AG and Helvetia Schweizerische Lebensversicherungsgesellschaft AG. Standard & Poor’s Global Ratings also assigned its “A+” rating to Helvetia Assurances S.A. with a stable outlook. | |

| Helvetia Schweizerische Versicherungsgesellschaft AG | 'A+' / stable |

| Helvetia Schweizerische Lebensversicherungsgesellschaft AG | 'A+' / stable |

| Helvetia Global Solutions Ltd. | 'A' / stable |

| Helvetia Holding AG | 'A-' / stable |

| Baloise Versicherung AG (Schweiz) | 'A+' / stable |

| Baloise Leben AG (Schweiz) | 'A+' / stable |

| Baloise Belgium N.V. (Belgien) | 'A+' / stable |

| Baloise Sachversicherung AG Deutschland | 'A+' / stable |

*The financial strength rating of Helvetia Assurances S.A. (Helvetia SA) is based on a guarantee issued by its parent company Helvetia Schweizerische Versicherungsgesellschaft AG (the “Guarantor”). The guarantee covers all legally valid payment obligations under insurance contracts concluded by Helvetia SA since 14 December 2012. The guarantee is unconditional, indefinite and binding for the Guarantor. Policyholders of insurance contracts issued by Helvetia SA are third-party beneficiaries of the guarantee. The obligations of the Guarantor arising from the guarantee are pari passu to the claims of all unsecured and unsubordinated creditors. Standard & Poor's regularly publishes an interactive rating for Helvetia.

Best's Credit Reports reproduced on this site appear under licence from A.M. Best Company and do not constitute, either expressly or implicitly, an endorsement of (Rated Entity)'s products or services. Best's Credit Reports are the copyright of A.M. Best Company and may not be reproduced or distributed without the express written consent of A.M. Best Company. Visitors to this website are authorised to print a single copy of the credit report displayed here for their own use. Any other printing, copying or distribution is strictly prohibited.

Best's ratings are under continual review and subject to change or affirmation. To confirm the current rating visit www.ambest.com.